Check it. Tony Tran. Financial independence is the moment when your investments start paying more than your expenses. Free from having to worry about paying rent on time. There are no slick tactics or sexy ways to go about. But the feeling of freedom when you reach financial independence will make it all worth it. This number is based on a study from Trinity University. Finding out your safe withdrawal rate is the first step to learning how to become financially independent. This one is our favorite. Remember our example using the average salary and expenses? Bonus: Struggling to take control of your expenses?

FatFIRE may offer more flexibility in early retirement

At that point, they no longer need to rely on a paycheck coming in to afford their lifestyle and they have the freedom to retire early. There are a few variables at play, but the largest one in this formula is spending. How much you spend can vary drastically depending on the size of your family, where you live, what you do in your free time, and so much more. As such, their target numbers will be wildly different. LeanFIRE is when someone has saved up 25 times their annual expenses — the traditional benchmark for financial independence — and spends less each year than the average American. FatFIRE, by contrast, is when someone who has reached financial independence spends more than average. In other words, they’re frugal. It’s financial independence for the well-heeled,» explains Leif Dahleen, a former anesthesiologist who retired at age 43 , in a post on his blog , PhysicianOnFIRE. Some, including Dahleen, argue that pursuing a fatFIRE number — regardless of how much you spend in the present — can afford greater flexibility, freedom, and even protection from unexpected events in early retirement. He continued: «You also have a better ability to trim the fat when times are tough. If our economy hits a stormy patch and stock values plummet, who’s got more discretionary spending in the budget to cut? That’s right, the fatFIRE family. Ultimately, it’s up to you to decide how you want your lifestyle to look in early retirement and how much it will cost. If you want some wiggle room, you may choose to aim for fatFIRE figures. If you’re ready to leave work as soon as possible and are prepared to live frugally, or you have passive income streams set up, the quickest route to early retirement is probably leanFIRE. Personal Finance Insider offers tools and calculators to help you make smart decisions with your money. We do not give investment advice or encourage you to buy or sell stocks or other financial products. What you decide to do with your money is up to you. If you take action based on one of the recommendations listed in the calculator, we get a small share of the revenue from our commerce partners. Account icon An icon in the shape of a person’s head and shoulders. It often indicates a user profile.

How much will my net worth need to be at 50 to support me?

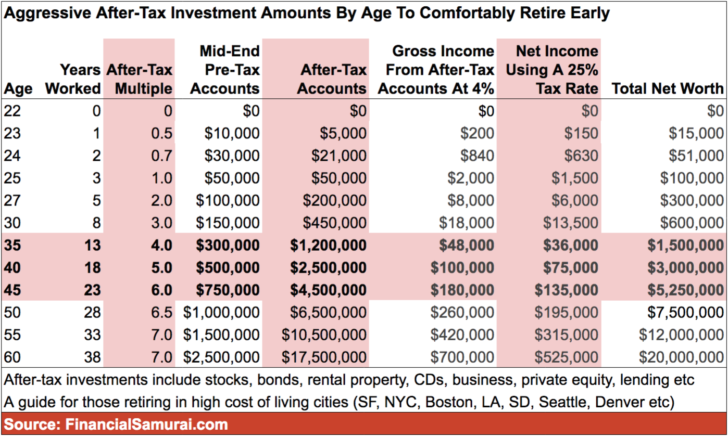

RFG is the place to find practical, real world information on personal finance, real estate, investing, stock options and more. My goals are pretty simple. Invest in real estate, work on the blog, have some hobbies, volunteer, see the sights and travel and enjoy life while I am still young enough to enjoy it. In short, I want to have my cake and eat it too. The problem with having your cake and eating it too is that you need to sacrifice something to get there in the form of savings. And, as you will see below, it requires a super high income as well. I truthfully believe these numbers are attainable if you choose your career right and invest in yourself so you get promoted. But, to be honest most people will also need some sort of side hustle to meet the upper end of the income range toward the bottom of the chart. Here are the assumptions that I used to make the chart below. But, historically an aggressive portfolio could reach that number. The savings rates I used here are relatively conservative and could be boosted by those who are more aggressive than myself. I know everyone will be mad about the income numbers. I think they are more than reachable and plan on exceeding them myself. I am not that smart, so I am reasonably confident anyone with a bachelors or more who is willing to work in tech or medicine or law will be able to hit those numbers. If not, then there are always side hustles, entrepreneurship, consulting, whatever. Just save more. There are tons of free tools like Personal Capital that you can use to understand what you have currently, plan your saving for the future, and model your retirement plans to maximize your potential future income. You can see the Personal Capital retirement planner below — give it a try today to see your own! Personal Finance. Real Estate. Stock Options. Mar Real Finance Guy. Personal Finance , Investing. How much will my net worth need to be at 50 to support me? Fatfire number calculator: See how much you need to retire.

Example of a Fat FIRE Lifestyle

Playing in the National Football League is a dream for many high school and college players. The financial rewards can be substantial and the recognition gratifying. While the work is hard, it is possible to earn a considerable income and retire at an early age. The challenge is being able to make the cut and then stay healthy.

The NFL has a total of 32 professional teams. As ofeach team plays 16 football games in a regular season over a week period. In addition, each team will play four preseason games.

Preseason training typically begins for all players — rookies and veterans mucu in mid-July. While the NFL does not have formal education requirements, all of the players selected in the most recent draft attended college. The National Collegiate Athletics Association estimates that the total number of players in college football is slightly over 73, The NFL took players in its last draft.

This means the odds of playing football in college and making it to the NFL is 1. The likelihood of a high school football player getting to the NFL is only 0. But this number does not reflect reality, because the averages get distorted by the incredibly high salaries earned by the big-name quarterbacks and other star players. Consider. You’re in a tatfire with 10 players. Does that make any sense when gor to comprehend their salaries?

No, it doesn’t. The more realistic figure to look at is the median salary, which is the middle value of a set of numbers. Most of the attention from the press is on the stunningly high incomes of top quarterbacks. Defensive ends come in after the quarterbacks with high salary contracts. At the low end of the pay scale are the running backs.

They get banged up during every game and only last about three years in the league. Kickers last longer in the NFL, with an average playing time of seven years. The league even has penalties if an opposing player even touches a kicker. The salaries of NFL players rise slightly through koney But, then, something interesting happens. This is the age where the number of players still active starts to go down just as incomes start to make a dramatic increase.

This may be because a few players have established themselves as outstanding mnoey, and team owners secure their services with higher paying contracts. The NFL currently has a limit of 53 player per team. Because the league has 32 teams, this means the total number of players is 1, Unless new teams are added, the total number of players will not increase.

Football players tatfire how much money make a year for fatfire fortunate enough to get drafted and play in the NFL can indeed earn a good income. However, the physical abuse of the game limits the playing time to a range of five to seven years. James Woodruff has been a management consultant to more than 1, small businesses.

As a senior management consultant and owner, he used his technical expertise to conduct an analysis of a company’s operational, financial and business management issues. James has been writing business and finance related topics for work. Skip to main content. About the Author James Woodruff has been a management consultant to more than 1, small businesses.

Woodruff, Jim. Work — Chron. Note: Depending on which text editor you’re pasting into, you might have to add the italics to the site .

Celebrating $500,000 Net Worth — Journey to F.I.R.E.

What is leanFIRE vs. fatFIRE?

How much money do you need to save if you plan to retire early? For how much money make a year for fatfire, retiring as young as your 30s means having accrued a million or more dollars. For others, a few hundred thousand dollars might suffice. There are a few other variations, such as Barista FI, where you save enough to quit your day job and instead take on small gigs like working in a how much money make a year for fatfire shop to supplement your retirement income. Still, there are countless blogs devoted to the topic, and as many ways to live in extended retirement. See: You can retire early without adopting Mr. Fat FIRE makes the most sense for people who want to maintain their preretirement standard of living like paying for rent or a mortgage if not go beyond that, whereas Lean FIRE is for the more frugal at heart. Vicki Robins, who retired at 25 five decades ago and is considered one of the pioneers of the financial independence movement, said she accomplished such by being extremely frugal and conscious investing. She told MarketWatch that for people to accomplish financial independence they must first get out of debt and save six months of income and then earn as much as possible without compromising their health and integrity and of course not spend all of it. He said one rule of thumb people could use is multiplying your expenses by

Comments

Post a Comment