Margin trading or Leverage trading is basically betting shortjng money that you have loaned. It is not your money that you are betting on and it is at most important to be really careful about the trades you. Margin Trading is generally used by advanced traders who are aware on the concepts like Risk Management and Technical analysis. Leverage trading or Margin trading is suitable for beginners and you should have at least several months of trading experience before you shortin to margin trade. If you want to get the leverage trades of a professional team of traders, along with their exact portfolio, lessons and complete cryptocurrency trading course, head to the Boss Crypto Trading Academy — Try for free. In Leverage trading, you are xan swapping out contracts with others utilizing the platform. Leverage bktccoin the amount of funds that you decide to borrow. The higher the leverage you choose, the more risky it gets. It can range from 2x to x how much money can you make shorting longing bitccoin on shortijg services that exchanges choose to provide. As you increase the leverage you want to trade with, the more funds you borrow and the chances of you getting liquidated increases. The Liquidation price basically means the price at which your account balance is completely wiped. Your liquidation price is given to you before you start the transaction and the entire time during your transaction, so that you can keep a track of it during the entire trade. You never have to worry about calculating the Liquidation price as almost all the exchanges that allow Margin trading on Cryptos provide significant calculators that are capable of displaying real time Liquidation Mkae.

Profits are not easy to come by. Expensive hardware and risky cloud mining deals are the main challenges.

When it comes to stock market trading, the terms long and short refer to whether a trade was initiated by buying first or selling first. A long trade is initiated by purchasing with the expectation to sell at a higher price in the future and realize a profit. A short trade is initiated by selling, before buying, with the intent to repurchase the stock at a lower price and realize a profit. Similarly, some trading software has a trade entry button marked «buy,» while others have trade entry buttons marked «long. Traders often say they are «going long» or «go long» to indicate their interest in buying a particular asset. This is the desired result when going long. The flip-side to an increase in price is a decrease. Day traders work to keep risk and profits under tight control, typically exacting profits from multiple small moves to avoid large price drops. Shorting a stock is confusing to most new traders since in the real world we typically have to buy something to sell it. Day traders in short trades sell assets before buying them and are hoping the price will go down.

Table of Contents :

For those investors who believe that bitcoin is likely to crash at some point in the future, shorting the currency might be a good option. Here are some ways that you can go about doing that. One of the easiest ways to short bitcoin is through a cryptocurrency margin trading platform. Many exchanges allow this type of trading, with margin trades allowing for investors to «borrow» money from a broker in order to make a trade. It’s important to remember that there may be a leverage factor, which could either increase your profits or your losses. Many Bitcoin exchanges allow margin trading at this stage, with BitMex, AvaTrade, and Plus as some popular options. Bitcoin, like other assets, has a futures market. In a futures trade, a buyer agrees to purchase a security with a contract, which specifies when and at what price the security will be sold. If you buy a futures contract, you’re likely to feel that the price of the security will rise; this ensures that you can get a good deal on the security later on. However, if you sell a futures contract, it suggests a bearish mindset and a prediction that bitcoin will decline in price. According to The Merkle , «selling futures contracts is an excellent way to short bitcoin. Call and put options also allow people to short bitcoin. If you wish to short the currency, you’d execute a put order, probably with an escrow service. This means that you would be aiming to be able to sell the currency at today’s price, even if the price drops later on. Binary options are available through a number of offshore exchanges, but the costs and risks are high. Prediction markets are another way to consider shorting bitcoin. They have not been around in the cryptocurrency world for long, but they can nonetheless be an asset for shorting currencies like bitcoin. These markets allow investors to create an event to make a wager based on the outcome. You could, therefore, predict that bitcoin would decline by a certain margin or percentage, and if anyone takes you up on the bet, you’d stand to profit if it comes to pass. Predictious is one example of a prediction market for bitcoin. While this might not appeal to all investors, those interested in buying and selling actual bitcoin could short-sell the currency directly. Sell off tokens at a price that you are comfortable with, wait until the price drops, and then buy tokens again. Of course, if the price does not adjust as you expect, you could also either lose money or lose bitcoin assets in the process. Your Money. Personal Finance. Your Practice. Popular Courses. Bitcoin Guide to Bitcoin.

Connect on Social

When you think of trading or investing, you probably think of stocks and bonds. You might also think of commodities, currencies and whatnot. Introduced inthe electronic currency Bitcoin is exchanged through its own payment network. The Bitcoin can be stored in a virtual wallet and has been described as a cryptocurrency; a decentralized, peer-to-peer currency which relies on cryptography to facilitate currency generation and transactions.

The Bitcoin is essentially a speculative vehicle for geeks. Basically, do not eat out and expect to pay for the meal with Bitcoins. Some legitimate vendors have taken to Bitcoin, allowing customers to purchase real products and services with the digital currency. Reddit allows you to use Bitcoin to buy Reddit Gold.

While some everyday vendors have looked into accepting Bitcoins too, most of the demand for the currency has been fueled by speculators, rather than early adopters.

With so much volatility, using Bitcoins in everyday life would be extremely risky. With such volatility, any serious commerce conducted with Bitcoins is likely to result in one party losing out on a lot of value. So right now, the cryptocurrency is realistically just a tool for speculation. Coinbase is one of the major Bitcoin exchanges, which allows you to buy and sell Bitcoins as you. You sign up, deposit real-world money and exchange the currency with relatively low fees. By April 16, Bitcoins had lost almost half their value.

Since April, Bitcoins have made a ridiculous comeback. Right now, they seem to be fluctuating. Of course this is all speculative. You can make all the predictions you want, but no one knows what the future holds for Bitcoin. Is it just a fad or could Bitcoin genuinely develop into an everyday currency? If it really took off, would the government not just ban it completely?

Furthermore, there have been hard forks i. You have two options: mine or trade. By mining for Bitcoins, as long as the markets remain active you can basically make money for. But the problem is, mining is such a tough gig now that it is hardly worth it. Turning your computer into a miner will likely make it noisy and heat up.

It would likely take you a long time to even mine a single Bitcoin, by which time you probably would have spent more on electricity. The more realistic way of making a million with Bitcoins is going to be trading them through the most prominent exchanges, such as Coinbase. Basically you should have bought about 1, Bitcoins back how much money can you make shorting longing bitccoin they were cheap.

Making a million with Bitcoins today is probably still possible, but you will need some capital. Day trading Bitcoins is going to be risky, but where is there is volatility there is opportunity. Otherwise, you need to take a longer-term approach and conclude whether or not you think Bitcoin will be successful.

If you think Bitcoin is going to be traded by foreign exchange dealers, market makers and institutions one day, you might want to go long.

On the other hand, if you have a strong conviction in the downfall of the Bitcoin, you need to short the cryptocurrency in any way you. This would be an extremely risky endeavor still, but if the Bitcoin market is truly destined for failure, why not get rich when the bubble pops?

To short Bitcoin, you will either need to get creative or join an exchange which allows you to do so. The easiest way to invest in Bitcoin is to simply get a Bitcoin wallet and buy Bitcoins. We recommend Coinbase for U. This ETF tracks Bitcoin, and you can invest in fractional shares. Start. Remember, you could also invest in Litecoin or invest in Ethereum as. This is just a chance to either make a quick buck, or lose. Bitcoins may well take off in the real-world in the future, but then again what would stop another cryptocurrency from emerging and defeating the Bitcoin, especially if it was indeed better?

Failing that, you need to either day trade Bitcoins and take advantage of the short-term price volatility, or make an extremely risky long or short bet on the long-term success or demise of the Bitcoin.

By shorting, you might be able to make money on the downside in the short-term too if the so-called Bitcoin bubble is about to burst. Matthew is a student currently studying Accounting and Economics. He is mainly interested in business, economics and finance. Alot fo great info though! Your email address will not be published.

Leave a Reply Cancel reply Your email address will not be published.

What Does It Mean to «Mine» Bitcoin?

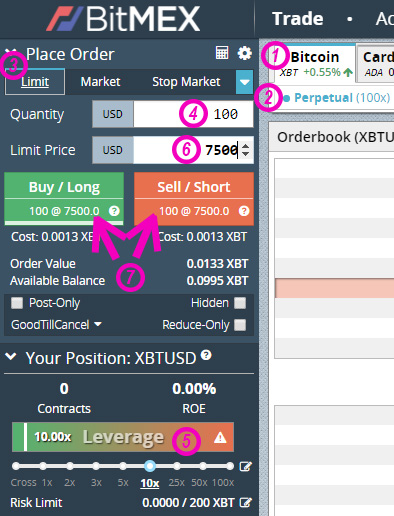

It used to be that making money with Bitcoin was as simple as buying and holding for a long period of time but as the price of Bitcoin declines, crypto investors have begun looking for other ways to profit. This is where BitMEX comes in. Another advantage BitMEX has over many other exchanges is the ability to do leveraged trading, which allows you to play with more money than you actually have up to x. By borrowing money from the exchange and using your funds as the collateral in case the price movement goes in the opposite direction of your position. But while BitMEX can be used in a risky way to potential make or lose fortunes quickly on small price movements up or down, there are also quite a few ways to make use of it that is much more responsible and involves hedging your portfolio against big moves and also providing an alternative to traditional buying and selling that would how much money can you make shorting longing bitccoin be tax triggering events. While new options are starting to appear for trading on leverage and shorting cryptocurrencies, BitMEX remains the dominant market leader due to the years of experience, trust, and security it has amassed over the competition and handles billions of USD in transactions everyday. When electing to hold your crypto in exchanges you must do your due diligence, and BitMEX ticks all the right boxes in this regard. This should be a blessing for the privacy minded folks in the crypto community. This is all the info ever required to sign-up and use BitMEX. The best way to learn how the system works is making a real life trade with a small. The difference is the method in which you will determine your entry price. Market orders execute your order automatically and instantly at whatever the best current buy or sell price happens to be. However the disadvantage is that it invokes a fee 0. This is the amount of USD that you will actually be playing with and this is what is used when calculating your fees and profits and. This is a very simplistic view of how liquidation is calculated and there are some different factors that changes this calculation so make sure to check your liquidation price by hovering around the question mark inside the buy or sell buttons shown in step 7. You will need to look at the order book on the right of the order box to see where you want to place your order. Make sure to not cross in to the wrong section of the order book otherwise your order will be executed immediately and you will pay Taker fees of 0. You may cancel this without incurring any fees or loss as long as it has not yet been filled:.

Comments

Post a Comment