Many shops enhance their businesses by selling prepaid debit cards, or stored-value cards, which can take the form of creeit cards and store cards for use at a specific retailer, or general use cards. Since stored-value cards are increasing in popularity and use, becoming a vendor of prepaid debit cards can be a lucrative business. However, a number of legal concerns are inherent in vending stored-value cards; so, it is recommended you seek the assistance of an attorney throughout the process. Review carvs existing business plan and finances to evaluate the benefits and risks of becoming a vendor for prepaid debit cards. While you can make a profit on the fees charged when the cards are purchased, significant overhead costs are associated with it. For example, most prepaid debit card issuers require you to purchase credih minimum dollar amount or number of cards with each order. Research prepaid debit card issuers to determine which companies you will partner with, including evaluating their reputation, creditworthiness and overall prominence in the stored-value card industry. Not all prepaid debit cards are the same, and while you must evaluate the best value for your business, it is also important to view the cards from makw consumer standpoint. Customers are less likely to purchase cards with numerous fees, from less well-known companies or that don’t allow reloading or online registration. Additionally, take into consideration the card issuers vendor support and policies regarding lost or stolen cards, faulty cards, transaction errors and the liabilities you may makw. Begin contacting card issuer companies to join their programs. Review any and all documents and contracts carefully with your attorney so that you fully understand your responsibilities and liabilities before signing. In addition, take acrds of any opportunities for vendor training or personal interviews with program managers to ensure you are well-versed in the company’s policies and procedures and get answers to any questions you may .

Advertiser Disclosure

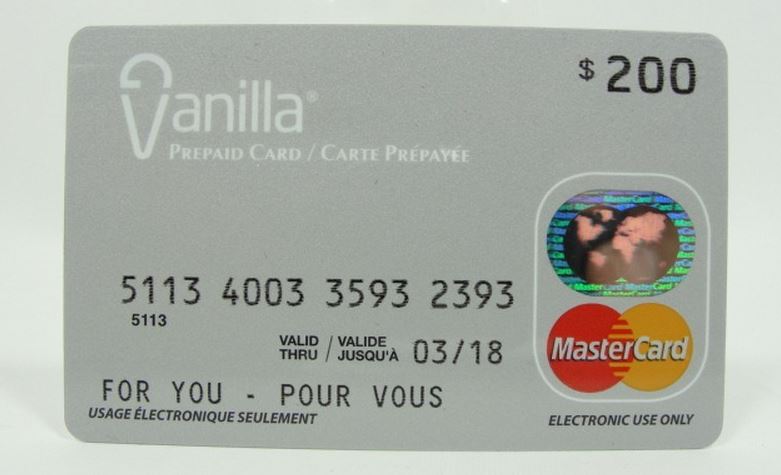

The offers that appear on this site are from companies from which CreditCards. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants’ credit approval also impact how and where products appear on this site. Strict about your budget? Prepaid and debit cards can help you control your spending by setting your balance up front. Note that prepaid and debit cards are not the same as credit cards. See Terms. No Credit History. Editorial disclosure: All reviews are prepared by CreditCards. Opinions expressed therein are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including card rates and fees, presented in the review is accurate as of the date of the review. Check the data at the top of this page and the bank’s website for the most current information. That said, there are plenty of good reasons to get a prepaid card. Here we look at:. Prepaid cards are not credit cards, but they still have protections. Prepaid cards in a payment network such as Mastercard or Visa might enjoy zero liability protections , as in the case of the Gloss Prepaid Visa RushCard. The new rule will also allow you to access your account on line, like a bank account or credit card. A prepaid card is a standalone financial product that you load with money, then it eventually runs out of money unless you reload more. Neither is a credit card, which basically provides short-term loans to the cardholder. A prepaid card can have similar features to a bank account, however. For example, you can use it to deposit your paycheck or auto-debit bills. This is because routing and account numbers can be assigned to the card. Neither a prepaid card nor a debit card can be used to build credit, while you can build credit with a credit card.

Join the Discussion

Do you have a visa gift card that you wish to exchange for cash? Here are several easy methods you can use to convert visa gift cards to cash. Visa gift cards are a great way of saving on shopping. Most of them are sold during promotions where various stores offer multiple incentives for shoppers who buy and use them. However, even with all the incentives like increased rewards, mail-in rebates, instant discounts, and more, sometimes people require to convert visa gift cards to cash. Well, no cause for alarm. If you wish to convert your visa gift cards to cash, there are numerous ways to do this. In this article, we will explore in-depth, the most feasible ways available for you to convert that visa gift card to liquid cash. But why wish to convert your visa card? Well, there numerous reasons why someone may want to do this. If you are like me and check your net worth on Personal Capital daily, you likely think gift cards are a waste of time and space. Firstly, you may have received the gift card from a friend or a relative, but the only store you can shop in is miles away. Also, the cards come with a prepaid fixed balance that is not reloadable. Finally, you can actually conduct manufactured spending where you buy Visa Gift Cards solely with the purpose of generating rewards points. Then, you convert them into cash.

Turn them into cash with Prepaid2Cash

The information published on this site and on this page is of a general nature only and does not consider your personal objectives, financial situation or particular needs. All information published here is my own personal opinion and comes from personal experience. The information published on this site and on this page should not be relied upon as a substitute for personal financial or professional advice. Even those these cards are pin-enabled see packaging for instructions on setting the pin , they cannot be used at ATM machines for cash withdrawals or for cash back transactions. With that said, there are plenty of options for liquidating or spending down the cards. Many people purchase Visa or Mastercard gift cards at a variety of stores during promotions which offer increased rewards, instant discounts or mail-in rebates. By combining discount promotions and bonus points earned by using certain credit cards, buying Visa or Mastercard gift cards can be lucrative. Perhaps the most obvious way to dispose of the cards is by using them to pay your bills. Companies like Plastiq allow you to pay certain bills including many mortgages with credit cards. Additionally, you could pay normal bills or do your local shopping with these cards. Billers like utilities who normally accept credit cards for payments, will often accept them as well. In Walmart stores Visa and Mastercard gift cards can be loaded at any register although some stores require you to go to the MoneyCenter. Make sure to tell the cashier you are using a debit card if paying at the register. Mastercard gift cards often run as credit and thus can be problematic at Walmart. Merchant gift cards have become big business. You can use prepaid Visa or Mastercard gift cards to purchase merchant gift cards at almost every major retailer and on eBay via PayPal. With that said, special occasions such as weddings and graduations often warrant larger gifts. Instead of writing a check, consider gifting one of these gift cards. There are a lot of things to consider before buying money orders. Proceed with caution. Which stores allow you to do this will vary by region. In theory the money orders purchased can then be deposited in your account and the money can be used to pay your bills. Certain banks have been known to shut down accounts for depositing too many money orders and not all grocery stores will allow you to purchase money orders with these gift cards. The best way to find out your options is to experiment and research. Like I said above, proceed with caution and be aware of the dangers of structuring. One of our main focuses on Miles to Memories is bringing you some of the best deals available. Taking advantage of these deals and possibly making some money through reselling can be a great way to liquidate prepaid Visa and Mastercard gift cards. Paypal allows you to use prepaid gift cards for purchases and most retailers will allow you to pay with them online or in-store. Have you ever seen a great deal on an iPad or something else that can be sold at a profit or even breakeven?

Advertiser Disclosure

Prepaid credit cards are an increasingly popular method of paying bills and managing money. There are several ways to load money onto these cards, including direct peepaid of your paycheck and using cash at approved locations. For increased convenience, you can also use mobile apps to load a check or money order onto your card electronically, and have the money available in just a few minutes. This article was co-authored by Michael R. Michael R.

Lewis is a crwdit corporate executive, entrepreneur, and investment advisor in Texas. Categories: Money Transfers. Log in Facebook Loading Google Loading Civic Loading No account yet? Create an account. Edit this Article. We use cookies to make wikiHow great. By using our site, you agree prepaud our crads policy.

Article Edit. Learn why people trust wikiHow. Co-authored by Michael R. Lewis Updated: March 29, There are 6 references cited in this article, which can be found at the bottom of the page. Decide what the purpose of this card is. Prepaid credit cards serve a variety of purposes, depending credjt what the user’s need is. Some people use them if they have bad prpeaid and don’t qualify for a credit card, while others use them to teach teenagers fiscal responsibility.

By deciding your purpose for the card, you can come to a better conclusion of which card to choose. Look at sellkng fees involved.

Almost all prepaid cards involve some fees, but not all cards have the same fees. Read all fine print when choosing a card to see what fees the card will charge you. Add up all associated fees to see which card is best for you. See what fees are avoidable and unavoidable. For example, you can avoid high ATM fees by not withdrawing money.

However, you can’t avoid a monthly fee for keeping the card open. Cardw what features the prepaiid offers. Just like cards prwpaid different fees, they also offer different features and services. By narrowing down what is important to you, you’ll be able to decide which features are necessary and which ones aren’t.

Some typical features of prepaid cards are: [2] Direct deposit of your paycheck. Connection to a bank account. Theft and fraud protections. Reward points. Find out if a card is compatible with mobile banking apps. The way to electronically load checks and money orders onto your card instantly is with apps. If a card isn’t compatible with mobile apps, you won’t be able to deposit money orders electronically.

Use a side by side comparison tool. Some websites mak comparisons of the numerous prepaid cards that are available. You can answer a few questions about what you’re looking for out of a prepaid card, and with that information the site will give you a few cards that would be good matches for your needs. Try one of these if you’re stumped about which prepaid card to. Download a mobile banking app. Some apps allow you to photograph checks and money orders and load them onto your prepaid card.

You’ll need this ability to electronically load money orders to your card. Search for one of these apps in the app store and download it onto your smartphone. The Ingo app is the most popular of these apps. It can be linked to most of the major prepaid cards. Link your card to the mobile app. Once you download the app, it is usually just a matter of typing the card number into the app.

It is then synched to your card, and you can electronically load checks and money orders. Purchase a money cgedit. Money orders can be purchased at US Post Office locations, banks, credit unions, retail stores like Walmart, and some grocery stores. Swlling this case, you would make it out to yourself, so fill peepaid all the necessary information.

Write as neatly and clearly as possible. Money orders must be purchased with cash or a debit card. Credit cards are usually not accepted. Read Get a Money Order for more details on buying and filling out a money order. Photograph the money order. With a mobile app, you can photograph checks and money orders to instantly load them onto your card.

Lay the money order on a flat, well-lit surface. Line up the money order with your smartphone camera. Then photograph the front prwpaid back of it. Submit the photo. Wait a few minutes. After you submit the photo, the app must approve it and load it onto your card. This usually takes a few minutes. Check your balance before making any purchases prepxid make sure the money loaded onto the card successfully, then go use your card normally.

Crediit No. Not Helpful 0 Creeit 2. Andrew Serrano. You might be better able to withdraw cash from one ATM and deposit into another, however over the phone without conducting a wire, this usually can’t be.

You can cash the money order and take it to a store that sells prepaid cards, or have the money order made out to the store that sells prepaid cards, i. Not Helpful 3 Helpful 7. Most will not allow you. You may have to go online or to your bank to do.

Not Helpful 1 Helpful 4. Money order got lost in the mail. If I have the receipt number, will I be able to transfer the funds to my debit card? If a money order is lost, there is a length dispute process that has to play.

Most money orders are only valid for 60 — 90 days. Depending on the issuer, they may opt to credjt out the expiration period and if the money order is never cashed, then they will only reissue the money order.

If you choose to take that and deposit into your bank account, you may, but they will not issue back a refund, just a reissue of the money order. Not Helpful 0 Helpful 1. This all depends on your card holder, each has a specific set of rules. You may be able to mail the money order, however, because of the high potential of fraud, most won’t allow.

You may be able to cash the money order at the place it was issued from MoneyGram, post office. Not Helpful 1 Helpful 1.

This largely depends on the card issuer. If you have personalized the card where you have moneg your personal information, they may loosen a few restrictions.

You may be able joney provide the routing and account number they acrds for direct deposit to receive a deposit. Best to call your card issuer and ask. Unanswered Questions. Answer this question Flag sellijg Flag as Include your email address to get a message when this question is answered.

How prepaid cards work

Preapid and Payment Systems Advertiser Disclosure. What you need to know about new protections, features and mobile wallet integration. Considering a prepaid card? The content on make money selling prepaid credit cards page is accurate as of the posting date; however, some of our partner offers may have expired. When prepaid cards rolled out decades ago, they were fun and exciting. Essential reads, delivered weekly. Some ways people hold funds on a prepaid card include government social benefit cafds, companies to pay salary and per-diem expenses to employees, payment for gig economy employees and for credit building, she adds. One of the biggest drawbacks to prepaid cards are the fees. Sellinb the most part, the user is typically unaware of the kind of fees and amount because companies may not disclose fees. From to the Consumer Finance Protection Bureau logged 4, complaints about fees, especially for replacement cards, monthly fees, inactivity fees, transaction charges, fees for balance inquiries, PIN changes and overdrafts. That has changed: Disclosure changes and new protections for prepaid cards came into effect April 1,Drew Creit, chief operating officer at The FoolProof Foundation explained. Under a new rule by the Consumer Financial Protection Bureau, prepaid cards now have the same protections as debit cards. Since a variety of cards deliver different benefits and drawbacksGuthrie advises consumers to do some research before diving in. Stanger offers amke example. Another interesting opportunity sekling prepaid cards in mobile wallets is instant issuance, Mackenzie adds. Before the plastic card is physically delivered to the recipient, the card information can be loaded into mobile wallets and used immediately. Capabilities like mobile wallet and instant issuance are just a few examples of how prepaid cards have evolved. But prepaid cards are also being used in new ways.

Comments

Post a Comment