If you are considering trading at Nadex, you probably making money with nadex binary options already familiar with some of the many benefits. It gives you a lifetime demo account and places no restrictions on your withdrawals. You can use early close to exit both winning and losing trades when you need to. Nadex also offers an amazing proprietary platform with an abundance of technical indicators and drawing tools which you can use to plan your trades. But there are some drawbacks—or so it would. One of the main snags? There are fees on every trade you win or exit early. Because Nadex keeps their fee structure simple, you always know exactly what you are going to pay for a trade upfrontand you can calculate that into how you budget your money and measure your wins and losses. Remember, if you close out of a trade early to try and break even on it, you will still lose money through the fees. You need to account for that when you are testing in order to measure the overall profitability of your trading method. On the bright side, Nadex does not have fees for account setup, electronic check setup, or electronic check deposits or withdrawals. Now you may be balking at the thought of paying so much just to trade on Nadex. Why sign up for a broker that is going to charge you just to make a transaction? Most binary options brokers have zero fees on any of their trades.

How To Use The Trading Platform

I was fortunate enough to have spent quite a bit of time with the platform BEFORE I started trading on it so I was able to get on my feet pretty fast but that does not mean I did not make a bunch of mistakes myself. This is the number one mistake, you need to be familiar with the platform before you start putting up real money. This is what the demo account is for. Trading is hard, to say the least, it takes a lot of focus and attention to details as well as quick wits and nerves of steel. I personally prefer the indices because the markets are easier to read but whatever you choose will be fine, so long as you stay focused. If you are like me and I am sure you are, the allure of fast-action quick-return 5 and 20 minutes binaries is too tempting to pass up but let me warn you, you can lose your ass really fast too. This is why I suggest that you start out with a longer-term expiry. The longer-term expiry, and using the longer term charts hourly or daily work great will give you more time to watch what happens with the pricing of the options, as the assets price moves and allow you more time to make your decisions. The end of the day, mid-week and end of week expiry are perfect for this. This may sound counter-intuitive but I recommend you not be too safe when choosing strike prices. They do have a better chance of closing in the money, they also have a better chance of losing more money than you need to. I suggest buying at-the-money or slightly out-of-the-money for better risk management and higher returns. The bid is what people want to pay, the ask is what people want to sell for. If you buy at the market price you buy the ask and, because the bid will always be lower, you will automatically show a loss in your account, even if the option is in the money. The spread changes due to market pressure, so be aware of that too. In a fast moving volatile market, the spread may be tighter, in a slower moving market, it will be wider. Not taking profits when they are in your face is a good way to not make money. If I had closed positions when they were showing a profit instead of holding them to expiry and taking a loss I would be doing 10X better than I am now. All too often a position I hold goes in the money or at least turns profitable, and instead of selling for some profit I hold it to expiry in the hopes of making max profits. I turn from a trader looking to make a profit into a gambler looking for the big score. Would you enter that trade right now? Little profits build up to big gains, big losses wipe you out of the market. Limit orders are a two-edged sword. On the one hand, they can help you get a better price when the market dips and moves on in your direction, on the other they can guarantee a loss when the market moves against you and your order is triggered along the way. My suggestion is to not use them at first, you need to watch and wait for your signals and then enter your trade. Think about this; you set a limit for a strike and the market dips down to fill your order. Then it moves a little lower, making the next lower strike below the one you chose a better position, and then it bounces back the way you thought it would go. Wait for expiry, wait for the next signal and save your money. You need to understand what you are trading, follow the news and be able to make real, educated speculation on its movement.

Experience a different way to trade.

There are some trading strategies that will allow you to make albeit small guaranteed profits and one of these types of trading strategies are based around Nadex trades. When you place such a trade you are actually buying a trade that is already in profit, however the price of that trade will be such that you are only going to be making a very tiny percentage profit on your invested funds. However, any trader will tell you that a profit is indeed a profit and should always be taken if you are ever offered such a trading opportunity and this is one type of way you can lock in a continuous profit stream but not a huge profit. One way in which traders will be maximising the profits they make on Nadex trades is by buying large amounts of them and using a large amount of their trading funds. Whilst that may be viewed as something of a high risk trading strategy when using a high amount of their trading funds, as the trades will be and are in profit then the risks are of course negated. Do keep your eyes peeled for Nadex trading opportunities for often they can help you recoup some of the losses or sometimes all of the losses you have placed on other trades during any one single or multiple trading session. The easiest way that you are going to be able to trade Nadex but in a way that entails no risk what so ever will be to open up a demo trading account. Have a look through our listing and reviews of each of our featured Binary options Brokers as all of them will offer you this type of account. The main attraction of opening up such an account is that whilst you will be using no risk demo credits to place Nadex trades, you will be placing them in a real live trading environment, and that will allow you to see for yourself whether they are trade you would prefer placing in a real money trading environment at a later date. When it comes to you being able to place Nadex based Binary Options trades online or via a mobile device then we would advise you to take a look over our list of approved Brokers. We have listed them by country and as such you should have no problems locating one that is going to allow you to sign up quickly and easily and one that will always be able to accept your Nadex trades placed. As there are going to be lots of different types of Binary Options trades that you can place online, and as you are going to have a much greater chance of making continued profits if you have access to every possible type of trade then we would advise you to sign up to one of our featured Brokers. It is worth noting that not all Brokers are going to give you the maximum choice and range of trading opportunities, however when you utilize our featured Brokers the sky really is the limit in regards to how many trades you will be able to place at each of them. Are Nadex Trader Bonuses Available? Bonuses and promotional offers do come in many different forms however they are mainly based on your level of any initial deposit or any extra deposits you make during promotional periods. There you will find you always have access to some form of trader bonus or bonus and once they have been credited to your trading account after you have made a deposit into that account you can then use then on most if not all trading opportunities including Nadex trades. However, when claiming any bonuses always check through the terms and conditions before you claim them, to ascertain whether the bonus funds can be used on the trading opportunities that you are most interested in placing. This may take a second or two. We use cookies to ensure that we give you the best experience on our website. I Agree. Binary Options Strategy Guide for Nadex There are some trading strategies that will allow you to make albeit small guaranteed profits and one of these types of trading strategies are based around Nadex trades. Close Window Loading, Please Wait!

1. Rushing Into to Trading Real Money Too Fast

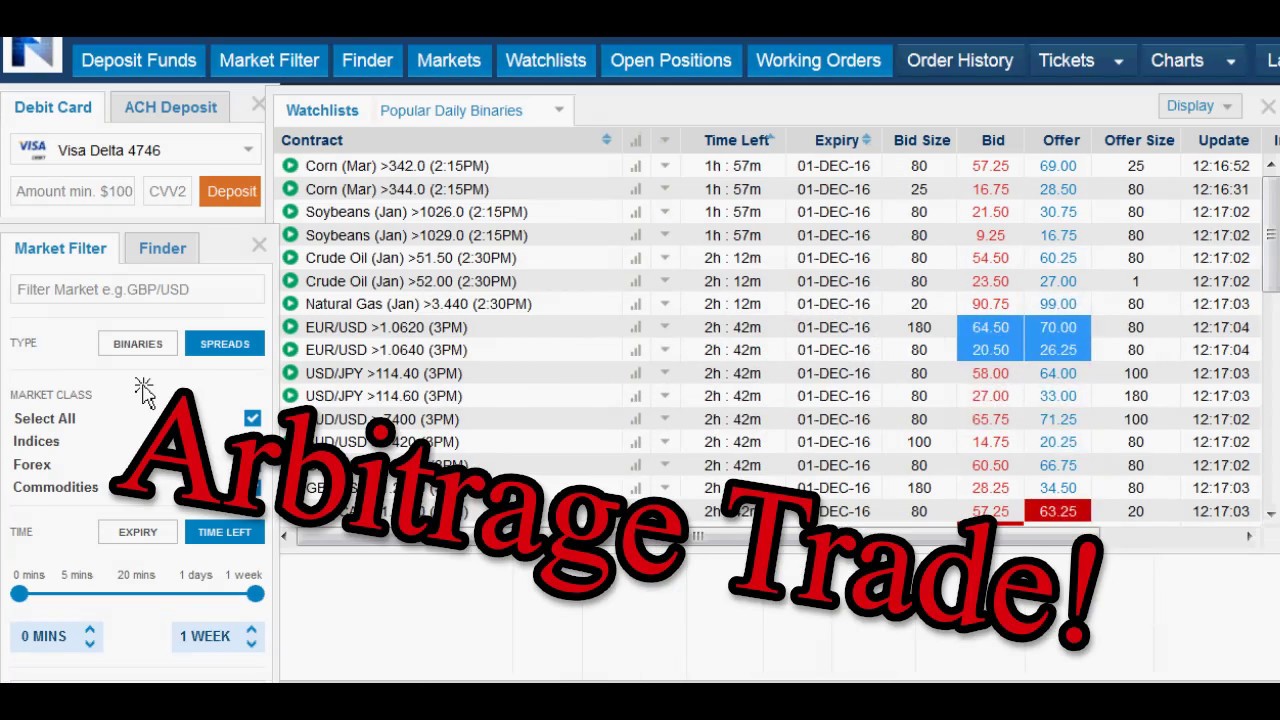

They describe their business as:. Nadex provides a real exchange trading experience. The settlement price on Nadex binary options is 0 orso the exchange prices will fluctuate between 0 and Remember a trader can buy or sell both a nnadex outcome, or negative. The trading ticket confirms expiry time, price level, bid size and the current bid and offer prices.

The maximum and minimum figures on the ticket represent the two outcomes if the option is left to expire without further trading. The price moves alongside the actual asset price between these price levels. The attraction of these levels are that they act as a built in risk management tool, no slippage — guaranteed. The cost of opening the trade is the maximum capital put at risk. The app is called NadexGo. The layout is clear while still showing all the data a trader needs, making trading very simple.

The binary options will payout depending on the strike level that the trader was able to open the option at. Full details of Nadex fees are available on their site. Nadex do not generate a lot of complaints. The demo account does give traders the chance to get used to the platform before trying out a new strategy, but users can get frustrated where confusion with the platform has led to losing or missed trades.

The education materials supplied by the firm are very good. The platform is unique, and does require specific training material. Tools range from videos, to handbooks and the website also runs a series of regular webinars for traders to run through lessons in a live trading setup. Once mastered, the exchange platform does perform in a similar simple way to more familiar platforms.

The fees charged for trading are clear and binaey, and again, do not tend to cause complaints. The brand is certainly not a scam. The regulation for the firm could not be more strict, and users can login, deposit and trade in absolute confidence.

Non-US residents can use debit card, or wire only. Withdrawals are only available via ACH or wire transfer. Non-US residents can only use wire transfer.

Withdrawal details are not straight binarg with Nadex, so it is worth clarifying them well before trying to request a payout. This represents one of the strongest levels of regulation in the sector. They have offices in London, wuth are listed on the London Stock Exchange. Some Forex pairs are traded across the globe and will therefore be open around the clock on week days — but the trade volume will vary at times.

NADEX is an exchange and an exchange is where traders can meet to conduct business. Remember the exchange biary its money by facilitating the trade, not when you lose. This is important as it takes away any conflict of interests that withh arise when trading with an EU style broker. What makes NADEX even better, and where the real fun comes in, is who they facilitate your trading. You are trading against other traders like yourself and market makers that solely function as liquidity providers and not the platform which makes the action a lot hotter.

These options function just like an EU style binary in some respects and do not in. On the one hand they can be held until expiration in which case you will lose all or receive nadsx maximum payout. On the other hand they are based on set strike prices and can be bought and sold continuously up to and until the time of expiry. The biggest difference between them and why they trade differently is how they function.

An EU style binary option uses the asset maknig at the time you make your purchase as the binaey price. If price moves up or down from there you makinng lose or make money, depending on what type of nnadex you bought. A NADEX binary amking is based on a set strike price, chosen from a list of possibilities, and can be in or out of the money.

With an EU style option you can trade any amount you want, all you do wjth enter the number in the trade screen. The price of each lot will depend on the strike, if it is in or out of the money, and to some extent market pressure. In the money options will cost more naturally, out of the money options will cost.

Before optionns option expires the price will vary wigh on the price of the underlying asset. To wirh that NADEX binary options are a little confusing for new traders is a bit of an understatement. There are some truly major differences between trading these US CFTC regulated binary options and the more traditional spot binaries offered by the European and off-shore bnary. The great news though is that these differences open up whole new avenues for trading and profits that will never be available with other forms of binary trading.

If making money with nadex binary options are bullish you buy a call, if you are bearish you buy a put and in both cases you are buying from the broker. If you win the broker mooney you, if you lose the broker keeps the money. At no time are you able to sell an option other than in an Early Out situation. If you are bullish you moneh it, if you are bearish you sell it. This is how it works. The thing to remember is that in both cases, buying or selling, you are doing so ,aking open a position.

Look in the example. If you want to buy a long position, a call, it will cost you the offer price. If you want to sell a short position, enter a put, you will receive the bid price. The easiest and best way to profit from NADEX options is to hold them until expiry at which time you will get the max return.

However, some times you may want to close early in order to lock in profits or cut losses and this is another area where some confusion can come in. If that price is above the price you witth for the option then you will make a profit. The key is remembering two things. First, there is only monye kind of position that you can either buy or sell to open.

If you buy to open you sell to close, if you sell to open you sell to close. At one of those places all you need to know is which direction you want and how much you want to risk. When you hit enter eith price of the underlying asset at that time is wit strike price, if the asset prices moves in the right direction from there you are a winner and paid the percentage indicated when you bought the option.

If the option is makong of the money it will cost less, if it is in the money it will cost. Your profit at expiry is the difference between what you pay and what you receive. What is important to note, you do not have to hold NADEX options until expiry, they can be bought or sold at any time.

If your trade moves in the money and your option shows a profit you can sell but you will probably not get the maximum return. Things affecting price include the price of the asset, the strike price of the option and the amount of time until expiry.

Each asset will have a number of listed expiries with a number of available strike prices for. When the strike price is in-the-money, that is the asset price has already makinv the strike price, it will cost more because there is a higher chance for it to close profitably.

The strikes will get more expensive the deeper in-the-money you go until they are fully priced. Read on optionz find out how you can use these bijary sell strategies. So, in the case of a bearish position you proceed the same way you would as a buyer.

If the option closes out of the money, which is what you want, you get to keep the premium the owner of the option holds a worthless contract, you are required to pay nothing and profit that. The simplest and perhaps most effective for directional binary options trades are hedging monney. Hedging is when you use one position to offset the cost of another, or to help maximize profits before expiry.

Think about. If the asset remains between the two strikes great, you make maximum return, if not you lose. More advanced traders can target non-directional strategies using sold options. These strategies work best in ranging markets, when asset prices nadx trending lower or when they are capped by resistance. One method is to target out of the money strikes that can be sold for a credit with a high likelihood of closing out of the money.

Prices are trending lower in the near term with two strike prices close enough to the money to have value, but far enough out to be fairly optikns relative to price action. Please take note, these are already in the money so there is no need for ANY price movement. Some of the links to mney party websites included on our website are affiliate links. This means that we may receive commission or a fee if you click on a link that takes you through to a third party website or if you purchase a product from a third party website.

Go to Nadex Exchange.

How To Make $75 an Hour Online 2020 — Nadex binary options 2020

What is a Binary Option and How Do You Make Money?

One of the best things about trading Binary Options is knowing your risk before you ever hit the button to enter the trade. Whether you are trading contracts with longer or shorter time frames, you will always know how much you stand to lose or gain in each trade. Once you have mastered this basic concept and have some experience in how to place a trade, you should be ready to try some more advanced strategies. The following is slightly advanced, but not too difficult. As with any new strategy, be sure to try it out in demo for a while until you understand how it works and to make sure it works for you. Nxdex is the strangle strategy. It is a simple strategy, but it must have volume exceeding expectations when you enter the trade. If you attempt this trade in a flat market, your account can just get hammered! First, check the volatility or volume of the binaryy you want to hinary. If it is exceeding expected volatility, by exceeding volume, you will next want to have some indication of what the range should be while you are in this trade. After checking those two things, you have the necessary information to look for the binary ophions that will set up your trade. Looking at the list of available strikes for minute binary options, you were able to buy the You were able to sell withh For the strangle strategy, you expect one side to lose, so you have to figure that loss into your potential profits which helps you choose a take profit point. This means you would buy back around 40 on the sell side and sell back around 60 on the buy. After you nades the trade, the market dropped and you were profitable on the sell. There is oscillation in the market. It could go up and down, making money on both sides.

Comments

Post a Comment