Investors often ignore the value of YouTube, cash and their Other Bets. Regulatory concerns seem way overdone. Even with big fines and changes to their business, Google can grow for many years to come. This service will utilize his 25 years of professional investing experience and is the result of screening of over stocks in androud of the highest quality investment opportunities at the best entry points possible. These are high return on equity, high free cash flow stocks with a proven track record in compounding earnings at higher than market rates. Seeking Alpha: Can you briefly summarize your bullish thesis for readers? Thomas Lott: Absolutely. Like many of my finds that I have written up on Seeking Alpha, Google is not only a fantastic company and blue chip growth stock, but also very interesting on a sum of the parts basis. These sum of goog,e parts stories need a catalyst for demonstrating that value. Often a spin-off, or an asset sale. But how google can make money off of android seeking alpha and behold, they decided to monetize certain Fox assets. A bidding war ensued omney FOX more than doubled since that write-up. Android I think is also worth a ton, although entirely ignored as an asset within Google. In the non-breakup case, assuming some fines and monitoring costs then the upside ofv potentially be just as strong.

Trending News

It is the dominant leader in online search, making most of its money from ads shown to people who type queries into its search engine. But Google also controls a large portion of the online advertising landscape via its publisher network, so many of the ads you see on different sites are actually served through Google. How can Google continue to grow and diversify its revenue streams away from online ads? Google is one of the major players in cloud computing through its Google Cloud Platform and G Suite range of enterprise services. Cloud computing is one of the most promising technological trends in the coming years and decades. It makes computer resources available on demand through internet access to high-powered datacenters that are distributed around the globe. Businesses can save money and increase efficiencies by offloading their computing resources to cloud computing providers like Google. Google is very focused on grabbing market share in the cloud computing space.

1. Cloud Computing

The EU may investigate Google because denying a license to a smartphone competitor could be seen as giving its own Pixel products an advantage. Huawei will be forced to look for Google alternatives, which could have several repercussions for Google, both short term and in the long run. Google’s stock may come under pressure with possible legal action from the EU and the rise of an alternative app ecosystem that excludes Google. There are two operating systems «OS» that run almost all smartphones. However, Google has recently decided to revoke the Android license of one of these smartphone manufacturers. The manufacturer is China’s Huawei. Although losing the ability to pre-install the GMS suite of apps could be a big blow to Huawei by making it hard to sell its smartphones, the actual impact is likely to more nuanced. Huawei can always fall back on its home market in China, which is the largest for smartphones and does not use GMS.

How much money is Microsoft making from Android?

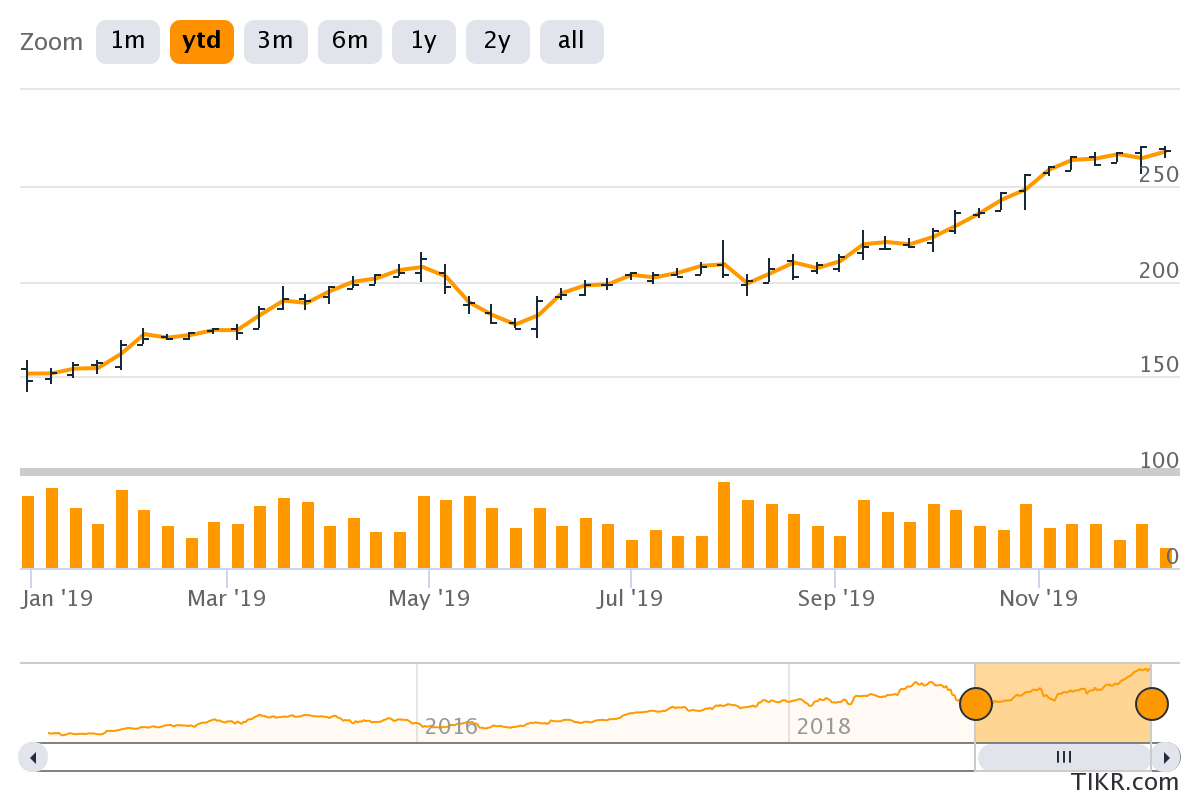

There is plenty of reason to believe that Alphabet Inc. With a current price just under 1, this may also be a very good asset to hold onto for a couple of years. Editor’s note: Seeking Alpha is proud to welcome Jack Foord as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. This article will attempt to reason the belief that Alphabet Inc. The valuation will use a forecast based on a mathematical approach to certain trends regarding how costs and required investment relate to these future earnings. An estimation for future PE ratios will then be used to forecast future share prices. As you will see, these arguments and forecasts will bring us to the conclusion that Google share prices currently underestimate the potential for revenue and earnings growth, providing with a very healthy investment opportunity. Google is together with Facebook, Inc. FB the biggest player in online advertising. Below, we can see the popularity of Google’s products by user. In terms of Google’s competition, perhaps it would be easier to list the companies Google does not compete. Moreover, in a bold move, Google recently announced it will be extending its operations to banking, offering users of Google Pay checking outs in collaboration with Citigroup. Google is by many accounts an outstanding company, combining both the appeal of a growth company with the profitability and financial strength of an established business. Source: Morningstar. Google is an established solid company in a growing industry and with no intentions of slowing down growth. One can only begin to speculate what direction their recently appointed CEO, Sundar Pichai will. In terms of growth catalysts, here are just a few ideas that, in our opinion, set Google to continue growing at its current pace, if not more:. As has been pointed out by many other analysts, YouTube is just beginning to produce the revenue it has the potential to. This stands to reason, being that YouTube is the second most visited website in the world. It is only a matter of time before YouTube comes out with its own equivalent to Netflix and Hulu. Google’s partnership with Citigroup could be just the beginning of a revolution in banking.

Comments

Post a Comment