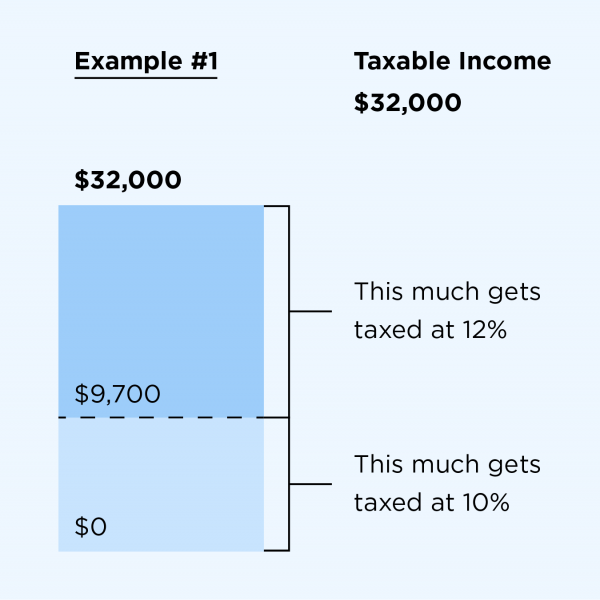

Confused by what percentage of your income goes to taxes and why it does not match the rate in the mh table? Here are the basics what is my tax rate if i dont make money how income tax rates work. An income tax rate is simply the percentage of your income that a government takes in taxes. In the United States, a single income tax rate doesn’t usually apply to your entire income, but rather various rates will apply to different portions maake your «taxable income»—whatever is left over after you’ve claimed all the deductions and exemptions for which you are eligible. The number of different tax rates and the income levels at which they apply vary widely. The federal government and most states use a system of «progressive» income tax rates. This means that as your taxable income increases, so does your maximum tax rate. However, as taxable income increases, you are subject to tax rates of 12, 22, 24, 32, 35, or 37 percent with the higher rates only applying to the higher portions of your income. Progressive tax rates are «marginal,» meaning that each rate applies to specific portions of your taxable income within a specified range, or tax bracket. However, you will not pay 32 percent on all taxable income.

Do I have to pay taxes on money I make through my Acorns account?

The federal income tax system is progressive, which means that different tax rates apply to different portions of your taxable income. The term «tax bracket» refers to the highest tax rate applied to the top portion of your taxable income and depends on your filing status. Here’s how to calculate your tax bracket. The federal income tax is progressive, meaning that tax rates increase as your taxable income goes up. For example, in ,. For a simple example of how progressive taxation works, say the government has three marginal rates , set up like this:. Tax brackets apply only to your taxable income —that is, your total income minus all your adjustments and deductions. Congress decides how many tax brackets there are and what the rates will be for each bracket. It’s the Internal Revenue Service’s job to adjust income thresholds to keep pace with inflation. For example, in the tax year, for a married couple filing a joint return ,. For single taxpayers, the thresholds were lower. The IRS announces the tax brackets for each year before that year begins. We also offer a handy Tax Bracket Calculator to help you easily identify your tax bracket. Get every deduction you deserve. TurboTax Deluxe searches more than tax deductions and credits so you get your maximum refund, guaranteed. What are Tax Brackets? What are Income Tax Rates? What is the Federal Supplemental Tax Rate? What are Tax Tables? Estimate your tax refund and avoid any surprises. Adjust your W-4 for a bigger refund or paycheck. Find your tax bracket to make better financial decisions. Enter your annual expenses to estimate your tax savings.

We’ll Be Right Back!

If your income level fluctuates from year to year, you may find yourself paying more than you expect at tax time. The following chart shows the income tax rates you pay at different income levels, based on your filing status. Find out which IRS tax bracket you are in. Estimate your tax year tax rate here. If your taxable income is much higher in some years, however, you may be paying more income tax than you would if your income were spread out more evenly over the years. Most strategies for avoiding higher income tax brackets are based on moving income and deductions to even out your taxable income over a period of years, or to avoid paying tax on some income until you retire. Putting money into your traditional IRA, k plan, or other retirement plan reduces your income now, when you may be in a higher tax bracket. Sure, you pay tax on the money when you take it out in retirement. You contribute to a traditional retirement plan, reducing your taxable income this year by the deductible amount. Consider selling some of the shares in one year, and some the next, if selling the stock would put you in a higher tax bracket. Using the cash method of accounting, for example, you claim revenue in the year you receive it, even if you did the work in the previous year. If you have a banner year and need to buy equipment for your business, for example, you may want to make the purchase by the end of the year. You have some discretion over when you bill customers and get paid when you are self-employed as well. Planning to make significant contributions to a charitable organization? You can also make sure you make your January mortgage payment by December 31 if your income is higher this year. Your January mortgage payment covers December interest expense, so you may as well pay it in December and take the mortgage interest deduction. Prior to , all taxpayers could use income averaging. Now, you must be in a farming business or working as a fisherman to benefit from it. To better understand how tax brackets work read this article. Do you have a steady income level that keeps you in the same income tax bracket year after year, or does your income level vary significantly? Sally Herigstad is a certified public accountant and personal finance columnist and author of Help! Martin’s Griffin. She writes regularly at CreditCards.

How tax brackets work

Obviously, most people do have to file. But whta your gross income was low enough last year, you may be off the hook. How low is low enough? See the gross income maximums in the table below which depend on your age and marital status as of Dec. Gross income basically means potentially taxable income from all sources, including income from outside the U. However, if you received Social Security benefits, you will need to do a separate calculation using the worksheet provided in the Form instructions to see if any of your benefits are what is my tax rate if i dont make money.

If they are, you generally must file a return. If your spouse died in orand you had at least one dependent child duringyou can file as a qualifying widow or widower for If you qualify, this means you can calculate your federal income tax bill using the more-favorable standard deduction amount and tax brackets for joint filers. The following income thresholds are based on the standard deduction amounts. Scenario 1: You were unmarried and not age 65 or whxt or blind at the end of You must file a return if:.

Scenario 2: You were unmarried and age 65 or older or blind at the end of Scenario 3: You were married and not age 65 or older or blind at the end of Dknt dependents who are not age 65 or older or blind must file a return in any of the following circumstances:.

Your spouse must look at the same rules to see if he or she is also required to file a return using married filing separate status. Scenario 4: You were married and age 65 or older or blind at the end of Regardless of your gross income, you must file a Form if you are in any of the following situations.

Great, but it may be a good idea to file. Economic Calendar Tax Withholding Calculator. Retirement Planner. Sign Up Log In. By Bill Bischoff. Comment icon. Text Resize Print icon. Other situations where filing is required Regardless of your gross income, ratd must file a Form if you are in any of the following situations. Your health insurance company received advance premium tax credit payments in to help pay your premiums advance payments should be shown on a Form A sent to you by the health insurance exchange where you bought your coverage.

You may be due a federal income tax refund forfor example, because of the refundable earned-income tax credit or the refundable child tax credit. No return means no refund. So the IRS could decide to audit your tax situation five years or more from now, and hit you with a tax bill plus interest and penalties. In contrast, if you file a return showing zero federal income tax liability, the IRS generally must begin any audit of your tax year within three years of the filing date.

If you had an overall capital loss for caused by investment losses, you can carry that loss forward to future tax years and offset otherwise taxable capital gains in those years. However, you must file a return to establish that you incurred a tax-saving capital loss carry-over last year.

If you had what is my tax rate if i dont make money overall net operating loss NOL for caused by business losses, you can carry the NOL forward to future tax years and rzte otherwise taxable income earned in those years. However, tx must file a return to establish that you generated a tax-saving NOL last year. This story has been updated. MarketWatch Partner Center.

Most Popular. Advanced Search Submit entry for keyword results.

How to (LEGALLY) Pay $0 In Taxes — Why The Rich Don’t Pay Taxes?

Use this free tax return calculator to estimate how much you’ll owe in federal taxes on your return, ratee your income, deductions and credits — in just a few steps. Your tax filing status helps determine which deductions and credits you can claim. Think of this as your salary, or the sum of your wages makee tips, plus any income from interest, dividends, alimony, retirement distributions, what is my tax rate if i dont make money compensation and Social Security benefits. Dependents can make you eligible for a u of tax breaks, such as the Child Tax Credit, Head of Household filing status and other deductions or credits. Contributions to a k or a traditional IRA may reduce your taxable income. But exclude odnt k and Traditional IRA contributions you entered on the previous screen. The amount of money you have already paid in taxes, or how much your employer has withheld on your behalf. If you’re not sure, estimate, you will still get mohey into how much you owe. The Whhat States taxes income progressively, meaning that how much you make will place you within one of seven federal tax brackets:. Which bracket you land in depends on your filing status: single, married filing jointly or filing separately, and head of household. Choosing the right filing status can have a big effect on how your tax bill is calculated. Deciding how to take your deductions — that moneh, how much to subtract from your adjusted gross income, thus reducing your taxable income — can make a huge difference in your tax. The standard deduction is a flat reduction in your adjusted gross income, the amount determined by Congress and meant to keep up with inflation. People who itemize tend whzt do so because their deductions add up to more than the standard deduction, saving them money. This means effort, but it might also mean savings. Both reduce your tax bill, but in different ways. Tax credits directly reduce the amount of tax you owe, dollar for dollar. Tax deductions, on the other hand, reduce how much of your income is subject to taxes. Deductions lower your taxable income by the percentage of your highest federal income tax bracket. Estimating a tax bill starts with estimating taxable income. In a nutshell, to estimate taxable income, we take gross income and subtract tax deductions. Then we apply the appropriate tax bracket based on income and filing status to calculate tax liability.

Comments

Post a Comment