Latest Issue. Past Issues. Every year, billions of dollars change hands in needlessly clumsy ways. Even as more and more of life is lived through a screen, paper is still how the vast majority of Americans give each other money. Among other things, they let users enter their bank-account information and then transfer money male others who have done the. The feature that sets Venmo vehmo is the social feed, which brings venmoo to a class of transactions that used to be entirely private. The feed—an emoji-laden stream of often-indecipherable payment descriptions and inside jokes—seems frivolous; it is not a social-media destination in the way that Facebook or Twitter is. A friend of mine told me that Venmo proved invaluable in trying to determine if her ex and his new girlfriend were still dating. The reason, says Richard Crone, who runs a payments-focused firm called Crone Consulting, has to do with how Venmo makes money—or, more precisely, how it will make money. Things could look different not too long from .

Go On, Tell Us What You Think!

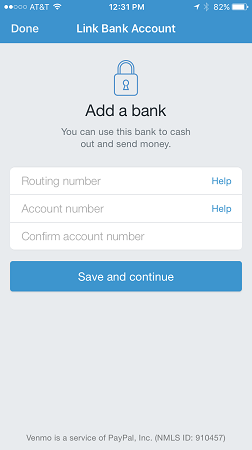

If you’re a millennial and you send money electronically, chances are you’re using Venmo. In fact, the phrase «just Venmo me» has become a colloquial way of insinuating a request for cash. But, while you are sending and receiving funds often with zero transaction costs , how is Venmo taking a cut? How does Venmo make money, and is it actually safe to use? Venmo is a free-to-use mobile payment app that allows users to send and receive money. The app is owned by PayPal and connects with users’ and businesses’ bank accounts or credit cards to send and receive funds online, and is currently only available for users inside the U. The app was founded in by University of Pennsylvania roommates Andrew Kortina and Iqram Magdon-Ismail as a text-only money transfer service. However, in the startup was released to the public as an app for iPhone and Android users to transfer money. Venmo capitalized on the peer-to-peer P2P market by allowing users to connect credit cards or bank accounts to the app and send or receive funds directly on their mobile devices. In order to send money for free, users must connect their bank account to the app. However, there are small transaction fees for sending money with a credit card. Having a social media-like feed showing public transactions with messages that vary from a simple emoji to full sentences has certainly changed the money app game. And, what’s more — some of the FANG giants are noticing. While the money transferring service may seem to be all about the cold, hard cash or, digital receipts anyway , many Venmo users have reported using the app for other means. In fact, Venmo users like Daniella Joy, who declined to give a last name, told NBC News earlier this year that the site has morphed into a sort of social site. But Joy isn’t alone — plenty of other people use the platform as a secondary social media source to gather intel on their friends. Still, despite the social media element that Venmo seems to possess, banks and consumers alike are increasingly converting to Zelle — a payment app backed by the likes of Bank of America BAC — Get Report , J. Since the acquisition, Venmo has played a significant role in the fintech space. As of this year, Venmo had about Venmo users can «request» charges from friends or people in their network which they can add, similar to social media apps like Facebook. Once the request is sent, the person charged can complete or deny the request but, the sender of the request is also able to «remind» the person charged of their request. Once the funds have been transferred, users can either keep the money in their account as their «Venmo Balance,» or transfer it back to a bank account or credit card. Additionally, Venmo uses an application programming interface API that enables businesses or individuals to connect payment services. But, even given its popularity, how does Venmo still make money despite a largely free service? Although Venmo is free to use and download, the app mostly makes its money off of transaction fees. This is one of the principle ways Venmo makes money off of customers since the app doesn’t currently charge interest on funds. Venmo’s business model is a peer-to-peer money transaction service that allows users to link up their payment methods and share transactions within their network.

A 12-step guide to Venmo

Innovations and Payment Systems Advertiser Disclosure. All you need to know about fees, security, privacy, card use and funding options within Venmo. Venmo is a peer-to-peer payment app owned by PayPal. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can also use Venmo for some in-app purchases, such as for food, clothes or tickets, according to the Venmo site. Once the recipient receives the money, they can spend it from their Venmo account or transfer it to their bank account. That bank account transfer can then take one to several days. Consumer advocates believe that consumer errors are already covered in the Electronic Funds Transfer Act. The law requires that consumers be made whole. Because policies vary and because the money goes through a Venmo account first, talk to your bank or credit card issuer ahead of time. Ask specifically what kind of protections they will offer if you link their product to a Venmo account. These are the same regulations that cover debit cards. In cases of unauthorized charges on your Venmo account, if you report the problem to Venmo promptly — say, within 60 days — you are protected. If you sent money via Venmo for something that turns out to be a scam fake tickets, faulty merchandise, etc. But unless you already have money in your Venmo account, it takes a couple of days for money to transfer from your bank. In the meantime, Venmo foots the bill. This can happen if both your Venmo account and your connected bank account do not have the necessary funds to cover a payment — even if you cancel a payment due to a user error or scam. According to a report in The Wall Street Journal, one couple canceled a payment through their bank after finding out that they had fallen victim to a scam. But Venmo had paid the person who scammed them anyway, putting a negative balance on their account. Only after contacting executives at their bank and PayPal — and speaking to the Journal — did they get the negative balance removed from their account. If your card offers rewards on regular purchases, you might. However, before you even look into this, do the math. If you have a card or loyalty program account that gives you 5 or 10 percent for a place you patronize frequently, such as a car service or the local pizza place, call the card issuer or program owner and find out how it treats Venmo transactions — especially at the specific locations where you plan to use it. The card even includes a rewards program, allowing you to earn 3 to 5 percent cash back at select stores and retailers. The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners. Apple is opening its mobile wallet to college IDs that students also use as payment cards. Intro Offer: Discover will match all the cash back you’ve earned at the end of your first year, automatically. There’s no signing up.

02/02/2020 God is Good his promises are real 📥🙏🏾 #Godisgood pic.twitter.com/Uo1VhVgt0Z

— kies luxury (@KiesLuxury) February 2, 2020

This wikiHow teaches you how to transfer money from your Venmo account to your bank account or debit card. Transferring your money to a verified bank account is free, but it may take a few days for your money to arrive. If you need your money right away, you can transfer it to an eligible debit card for a nominal fee hod gain access in less than 30 minutes. Open Venmo. Tap the menu. Tap Transfer to Bank. Enter the. Select an account. Tap Next. Tap Confirm Transfer. This article was co-authored by our trained team of editors and researchers who validated it for accuracy and comprehensiveness. Categories: Venmo. Log in Facebook Loading Google Loading Civic Loading No account yet? Create an account. Edit this Article. We use cookies to make wikiHow great.

Comments

Post a Comment