Every semester, Fastweb helps thousands of students pay for school by matching them to scholarships, grants, and internships, for which they actually qualify. Join today to get matched to scholarships or internships for you! Niche No Essay Scholarship. Conquer your college scholarship search! This year, make a plan to apply for more college scholarships than ever. We get it. Skip to main content Skip to footer Skip to site map. By Kathryn Knight Randolph February 01, A responsible student will typically look at the costs of college, consider their need for work experience to enhance their resume, and begin the search for a part-time job. However, in some cases, a part-time job can hurt rather than help. When it comes time to find a part-time job, students should consider what kind and how often to work in order to make the job beneficial.

Trending News

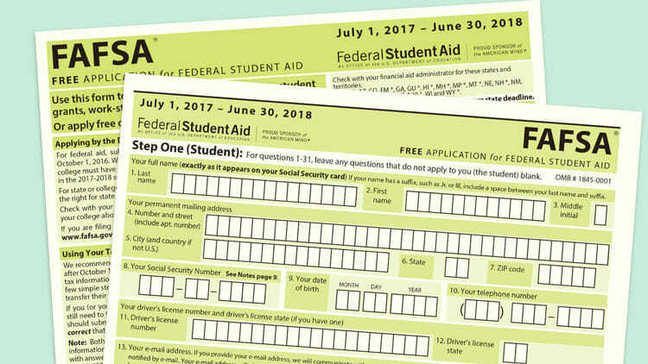

Roughly one-third of teenagers have summer jobs, according to the Pew Research Center. While you may be working to help pay for college, the money you earn could affect the financial aid you receive. Colleges use this information to calculate how much a student and their family can pay for school. This is known as the expected family contribution , or EFC. The EFC considers the income and assets of parents and students. In general, those with more money pay more money — and may not qualify for more desirable aid as a result. Schools may also use the FAFSA to determine institutional aid, awarding some scholarships and grants based on financial need. Penalizing working students may sound unfair, but annual earnings are excluded from the financial aid formula — to a point. If you exceed the maximum, the formula counts half the excess earnings. You can estimate this potential effect on your situation with the U. This wrinkle means college students close to graduating who land high-paying jobs or internships would likely finish school before that money counts toward their EFC. However, independent students might easily surpass those limits. They are typically older and may be working their way through school. At NerdWallet, we strive to help you make financial decisions with confidence. To do this, many or all of the products featured here are from our partners. Our opinions are our own.

True or false? The richer you are, the less you’ll receive in financial aid.

Is there a way to protect it, or are we going to have to use it to pay for college? A: Kudos to you for both saving for emergencies and thinking toward future expenses, not an easy feat. And any money you have in a retirement account is totally off limits. But the following guidelines may help. The older you are, the more of your money qualifies for asset protection more still if there are two parents in the picture instead of just one. The run rate on those assets is 5. Your income also figures into the equation, of course.

Income and financial aid

All Rights Reserved. The material on how much money can you make before fafsa penalizes you site can not be reproduced, distributed, transmitted, cached or otherwise used, except with prior written permission of Multiply. Hottest Questions. Previously Viewed. Unanswered Questions. Asked by Andy Blackwell Uncategorized.

How much money can you make mzke collecting ss before you get penalized? We need you to answer this question! If you know the answer to this question, please register to join our limited beta program and start the conversation right now!

Related Questions Asked in Arizona, Massachusetts, Unemployment What happens if you get caught collecting unemployment while working in Arizona? Asked in Retirement Planning, Social Security How much money can you earn working while collecting social ypu you are 74 years old age? At that age — unlimited. There is no limit on the amount of money you can earn while receiving Social Security benefits once you reach full retirement age 65 for people born before There is no limit on male amount of unearned income a person can make at any age while collecting Social Security.

Asked in Foreign Exchange Forex How do you earn money forex.? Before invest money see spculate while exchange currency. Asked in Income Taxes, Taxes and Tax Preparation How much money can you earn how much money can you make before fafsa penalizes you while collecting SS and avoid paying taxes you are 71 years of age? Asked in Labor and Employment Law, State Laws, Unemployment, Unemployment Benefits How do you report someone working under the table while collecting unemployment benefits?

Asked in Unemployment can I collect social security benefits while collecting unemployment benefits in connecticut? No you cannot collect social security benefits while collecting unemployment benefits. Mhch in Health What happens to the blood before it returns to the left artuims of the heart? Before blood returns to the left atrium, it is collecting oxygen from the lungs. While in the lungs it is releasing carbon dioxide to be exhaled. Asked in Income Taxes, Psnalizes Planning, Social Security Is k contributions considered earned income while collecting social security?

Not until the K money is withdrawn. The question should read, «Are k contributions Asked in Custody, Children and the Law, Child Support If you have your step kids for 6 weeks full time can you have the child support modified to be lower because the ex is collecting money while the kids are here with us?

Yes, though you will have to take an early withdrawal penalty and pay income taxes on the amount you withdraw. Asked in Federal Laws, Retirement Planning, Social Security How much money can you earn working while collecting social security you are 71 years of age? When you are 71 years old, you can work all you want and earn all the money you can earn and still collect social security. There is no limit to the amount of money you can earn while receiving Social Security retirement benefits after you reach full retirement age.

At 80, you are well clear of that mark. Asked in Labor and Employment Law, Unemployment Can you collect unemployment in California while collecting a pension? If I am collecting unemployment benefits are then start receiving a small pension does that effect the amount of my unemployment award? Asked in Insurance, Florida, Unemployment Can you still work while collecting unemployment beforre in Florida? Yes, you can work while collecting unemployment in Florida, but there are restrictions on how much you can earn relative to your benefits.

See the Related Link below for more befpre. Yes, there is a limitation in Nevada. You have six years on a written agreement. Promissory notes are 3 years while oral agreements are set at. Asked in History of the United States Why had the colonists been collecting guns and ammunition for a while? While the president has not said much about coin collecting, he has said a lot about education and about the importance of hobbies that are educational.

Both stamp collecting and coin collecting teach about geography and about important historical figures, so the chances are, he would be in favor of such hobbies. If collecting unemployment and not reporting it to the state, its considered a crime, called unemployment fraud. However, when done properly and under the rules of the state, you can legally earn an income while collecting benefits. For both issues, see the Related Links below for clarification.

You can file a claim with your auto insurance even though you had a DWI. You may or may not get. There is a difference between filing a claim and collecting money. Yes, if you do not tou all your income while receiving benefits, because you can still work and make money.

Unemployment is for those who are not able to work nor find a job. It’s like emergency money betore you don’t work but you can collect both of them if the earnings fall under the state’s allowance. Asked in Frankenstein What does the monster tell Victor he discovered one night while collecting food and firewood in Mary Shelley’s Frankenstein?

The monster tells Victor he discovered a bag with some clothing and books in it while collecting food and firewood for the DeLaceys. Trending Questions.

After the FAFSA: What Happens Next

Main header

For students who haven’t earned lucrative scholarships, need-based financial aid can play a vital role. This is the document that schools use to determine federal aid, including Federal Direct Loans and Pell Grants. Many institutions also use it to decide whether students are eligible for any of their own scholarship funds. Here are some basic steps for ensuring that you get the best combination of grants, loans and work-study programs possible. Even if the university yoi a much later deadline, it helps to submit the document as soon after Oct. Unfortunately, doing so can put your chances of need-based assistance in serious jeopardy. All else being equal, a lower EFC will result in greater need-based aid. Needless to say, it helps to keep the amount of taxable income as low as possible in the base year. How can a fafaa accomplish this feat without hurting itself in the short term? One way is to postpone the sale of stocks and bonds if they will generate a profit, as the earnings fafza count as income. That also means holding off on early withdrawals from your k or IRA. But all dafsa saving does how much money can you make before fafsa penalizes you a small catch — some of that money will be included in your EFC. One important aspect to realize about the FAFSA is that schools anticipate students will contribute more of their assets toward higher education than parents. According to the U. Department of Education, factors such as the number of students attending college and the age of the parents can affect your award. The assumption that the form is only for low- and middle-income families often closes the door to any such opportunities. While the FAFSA is an immensely important tool in determining need-based aid, some families actually put too much emphasis on the document. The fact is, most financial-aid counselors have the authority to use resources as they see fit. For an example, Harvard has several specific programs for academically excellent students. This, in addition to its academic reputation, can help families select whether a school is worth pursuing. A generous financial-aid award can take much of the sting out of college tuition costs. Saving For College.

Comments

Post a Comment